Good Monday morning and welcome back. It's the start of a new week so let's get right to our objective review the key market models and indicators and see where things stand. To review, the primary goal of this weekly exercise is to remove any subjective notions I might have in an effort to stay in line with what "is" happening in the markets.

The State of the Trend

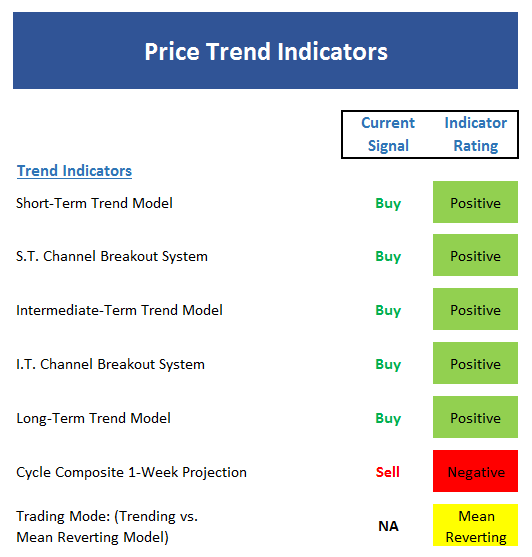

We start each week with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

Executive Summary:

- With the Dow and S&P 500 closing at new all-time highs on Friday, it is not surprising to see the short-term Trend Model positive.

- Both the short- and intermediate-term Channel Breakout Systems remains positive

- The intermediate-term Trend Model looks good.

- The long-term Trend Model is also a bright shade of green at this time

- The Cycle Composite points down this week before turning up for the next two.

- The Trading Mode models continue to point to a mean-reverting environment

The State of Internal Momentum

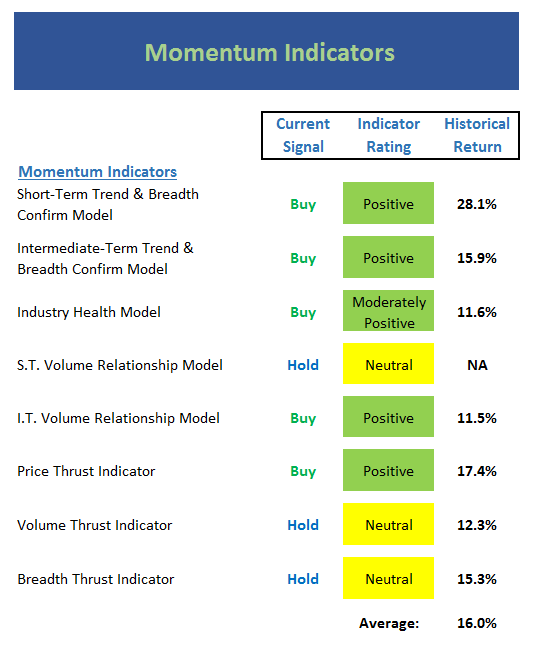

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend...

View Momentum Indicator Board Online

Executive Summary:

- The short-term Trend and Breadth Confirm Model remains positive

- Our intermediate-term Trend and Breadth Confirm Model has been a good guide lately and is still green

- The Industry Health Model continues to muddle along in moderately positive territory

- The short-term Volume Relationship is positive, but not by much

- After flirting with a breakdown, the intermediate-term Volume Relationship model improved last week and remains positive

- The Price Thrust Indicator moved back to positive last week.

- The Volume Thrust Indicator ...