When a decline in the S&P 500 approaches -1%, I tend to sit up and take notice. Especially when the decline occurs during a period of low volatility and/or comes out of the blue. And generally speaking, when such a dip occurs, there is usually some sort of headline to cause traders to locate the long-lost sell button.

As such, yesterday's pullback of -0.86% on the S&P, which was accompanied by a dive of -1.61% on the NASDAQ Composite and -1.83% on the NASDAQ 100, certainly got my attention. However, this time around, there wasn't an obvious catalyst. So, when I asked some of my bearish buddies what was what, the reply was, "Sometimes it takes a village."

In other words, the bears didn't have a single trigger to turn what appeared to be another mundane summer market session into a rout. No, they had a full quiver of little things that, when taken together, was apparently enough for traders to hit the sell button early and often yesterday afternoon.

Here's the list and the executive summary from our friends in fur:

Draghi Hints The End is Near: Super Mario (aka ECB President Draghi) hinted yesterday that the ECB could begin to wind down and/or take steps to reduce monetary stimulus. This, when coupled with the Eurozone's inflation data resulted in a selloff in the bond market that was global in nature. I.E. yields spiked higher. The fear here is that if the globe's central banks all walk back their stimulus efforts, a bear market in bonds could ensue.

IMF Downgrades US Growth Prospects: The IMF cut its forecast for US economic growth in 2017 from 2.3% to 2.1%, citing uncertainty relating to policies on tax reform and an agenda that negatively impacts the middle class. The report also pointed to the long-term challenges of an aging work force.

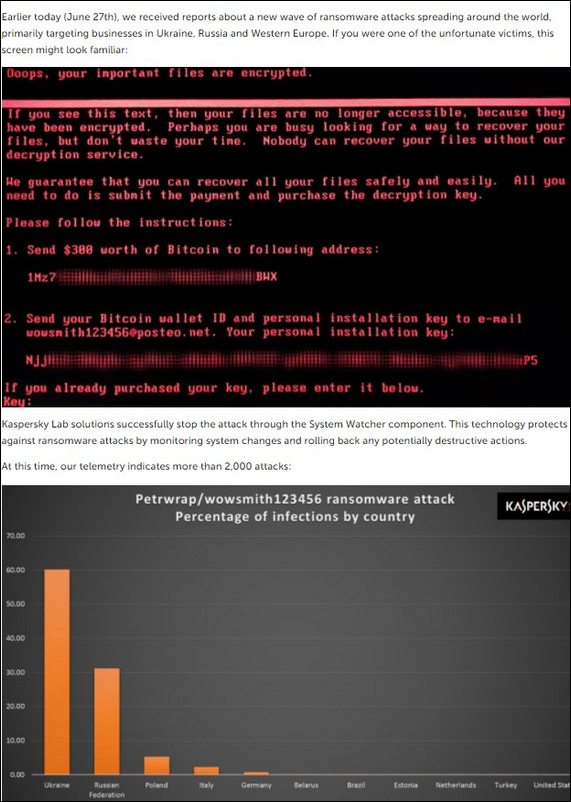

Another Cyber Attack Hits Europe: Another nasty cyber attack, which started in Eastern Europe, caused investors to raise an eyebrow relating to the potential for a bigger problem in this area at some point.

Source: securelist.com, WSJ.com

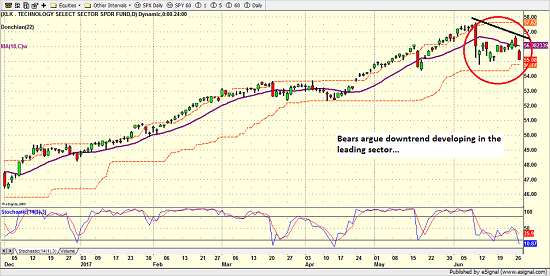

Tech Hit Again: Yes, tech has run a long way in 2017. And yes, everybody knows the run is extended and that tech is due for a pullback at some point. However, the key to this market is the anticipated pullbacks don't ever seem to materialize. So, with Google being slapped with a $2.7 billion fine in the EU for anti-competitive practices, the bears had a nice excuse to take another shot at getting something going for their team in the high profile tech sector.

Technology Select SPDR (XLK) - Daily

View Image Online

The key here is that if the market leading tech sector actually enters a downtrend, the overall market is likely to follow suit at some point. As such, we're keeping an eye on June lows for the XLK.

Yellen Worried About "Asset Valuations" (Again): Although this is becoming a familiar refrain for the Fed Chair, Janet Yellen said that asset valuations (aka the stock market), by some measures "look high." Yellen added, "Valuations are somewhat rich if you use traditional metrics like price earnings ratios." While Yellen also suggested that she doesn't know what valuation levels are appropriate and that interest rates certainly enter into this discussion, the fact that she is talking openly about valuations brings the fact that stocks are overvalued to light.

Health Care Bill Delayed: Although there had been a lot of talk about getting the GOP health-care vote done before the holiday recess, yesterday Mitch McConnell officially announced that the vote would be delayed. The bottom line here is that market participants don't care that much about this fight, but they ARE concerned about the GOP's ability to get tax reform done in a timely fashion.

Source: WSJ.com

Our friends in the bear camp also point out that tax reform may be currently priced into the market and any degree of failure to get this done in 2017 could cause some selling.

Tis The Season: And finally, the end of the quarter and the first half of 2017 arrives on Friday. Thus, the traditional window-dressing/profit-taking is likely at work now. Lest we forget, traders like to "dress up" their portfolio holdings (in order to try and convince investors that they held all the good stuff the entire quarter) near the end of quarters. So, this time around, managers may be looking to "undress" some of that tech exposure. Stay tuned on this one.

So there you have it; a plethora of excuses for anyone seeing the market's glass as half empty to do some selling. The question of the day, of course, is if Tuesday's decline will be the start of something serious or just another in a long string of one-day wonders.

Thought For The Day:

Remember, there are no mistakes in life - only lesson to learn from.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the U.S. Economy

2. The State of Earning Growth

3. The State of Trump Administration Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member