Modern times demand modern thinking in portfolio design. Learn more...

Well that was interesting. For the past six trading sessions, the stock market has been busy pricing in what became known as a "BREMAIN" vote. While the polls on the issue of the U.K. leaving the European Union continued to suggest the contest was too close to call, traders apparently came to believe that the "Remain" vote would prevail.

In fact, traders were so confident that the BREXIT wouldn't happen that the S&P 500 surged into the close Thursday afternoon, finishing the day with a gain of +1.34%. The thinking apparently was, "What, me worry?"

However, in the wee hours of Friday morning, the key word appears to be, "Oops!" (Well, that and "margin call.")

By now, you know that the Brits have seen enough of the EU and have voted to take a hike. European markets are in turmoil. Currencies are trading wildly. And stock futures in the U.S. are pointing to a downright ugly open. Good times.

My Quick Take

So, what should the takeaway be this morning? Here's what I told my team this morning on our internal messaging system:

- "BEXIT Wins... Market had been expecting BREMAIN. Cameron announced resignation. European stock markets plunging (FTSE -4.5%, DAX -7.03%, CAC -8.45%). Dow futures are off 550. The big worry is the state of the European banks. The fear is money will flow out of the banking system and create another crisis. And since it's Friday, things could get ugly in the U.S. But the bottom line for us is: Our advisors should be preparing to buy the dip when the emotion subsides."

In my humble opinion, this poorly written blurb pretty much sums it up. But obviously there is a little more to this issue.

The Big Issues

First, there is the issue of the UK economy. The key question here is if the dive in the markets will have a negative effect on consumer spending.

Next, is the issue of trade. While many analysts believe that Britain's leaders will negotiate a trade agreement that winds up looking not too dissimilar from the current deal, the concern is whether or not the U.K. will have the same access to other markets for trade and investment.

Then there is the future of the EU. With a handful of elections in Europe coming up, another big question is if the U.K. decision will embolden others and further fragment the European Union.

And finally there are the banks. IMO, this is really what the markets really care about. It is no secret the European banks are not in great shape from a balance sheet perspective and have been receiving a helping hand from the ECB for quite some time now. The worry here is that investors may decide to forgo the risk and move their capital to safer havens.

And as investors have learned since the end of the financial crisis in early 2009, it is the state of the global banking system that is becomes the focal point during times of stress. As such, our furry friends in the bear camp are busy telling anyone who will listen that this is the next "Lehman moment." The idea is that European banks will start to fail and create a chain reaction, ending in contagion. Joy.

Central Banks Standing Ready

With their crisis playbooks close at hand, the central bankers of the world aren't wasting any time here. Thus, the word of the day from the world's bankers is "liquidity," as in liquidity will be provided as needed.

Some banks have already taken action. The Swiss National Bank intervened to stabilize the franc. The Bank of Japan says it stands ready to act. The Bank of England said it is ready to pump 250 billion pounds into the financial system. And the ECB said in a statement that it is prepared to provide liquidity.

Here at home, the idea of Ms. Yellen hiking rates in the near future seems highly unlikely given the events of the day. Prior to the BREXIT vote, the odds of a hike were near zero for July and slim for September. Now folks are talking less about September and more about December.

As such, after the dust settles from the U.K. vote, one could argue that the game of global central bank intervention will continue unabated. As we've learned, that new money has to go somewhere. And since the U.S. remains the safest place in the world to invest, stocks are likely to find support long before things get too far out of hand.

The Technical Take

With the S&P projected to open down 70-80 points, the near-term question is if the anticipated ugliness will change anything from a technical perspective.

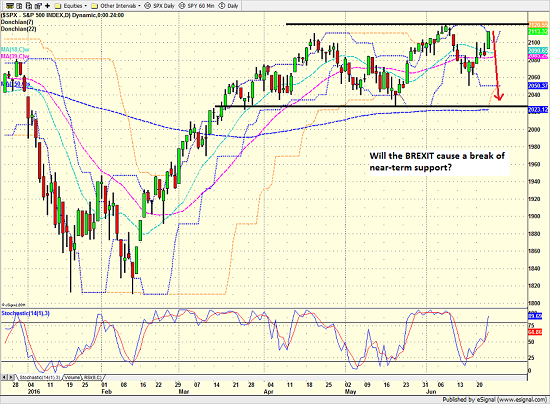

S&P 500 - Daily

View Larger Image

Assuming an early dive of 80 points, one could argue that short-term support at 2040 will be under siege. However, with both the 150- and 200-day moving averages sitting around 2020 (2023 and 2020 respectively) I'm thinking that this will be the real line in the sand. Thus, I'd wait for a clear break of 2020 on a closing basis before getting overly excited here.

For me, the bottom line on this fine Friday morning is to remain calm. If we've learned anything in the last 7 years it is that panic selling doesn't help. Thus, I want to see the real reaction from the markets over the next couple of days before making any big decisions. The good news is that our strategies designed to manage risk are doing just that. So, I don't feel any urgent need to take action.

Finally, as I've said a time or twenty over the past year or so, I continue to believe that this move will represent a "dip" worth buying from an intermediate-term perspective.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The Impact of the "BREXIT"

2. The State of U.S. Economic Growth

3. The State of Fed Policy

4. The State of the Stock Market Valuations

Thought For The Day:

No wise man ever wished to be younger. - Jonathan Swift

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+'://platform.twitter.com/widgets.js';fjs.parentNode.insertBefore(js,fjs);}}(document, 'script', 'twitter-wjs');Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member